G.T.E (GTE Innovation) simply represents "" Is there a Global Token Exchange? Not precisely. While there is a Global Token (GLT), what Brown is in fact referring to is the process of transforming digital and physical possessions into publicly-traded tokens such as the ones you have actually been seeing recently opting for unreal total up to "own" them.

Now, believe for a minute, the sports card collection you have sitting in your attic might be tokenized and traded. Vintage film posters. Much of the nostalgia from your childhood could quickly be on the exchange. But believe bigger. Art. Precious jewelry. And even bigger still to services and property.

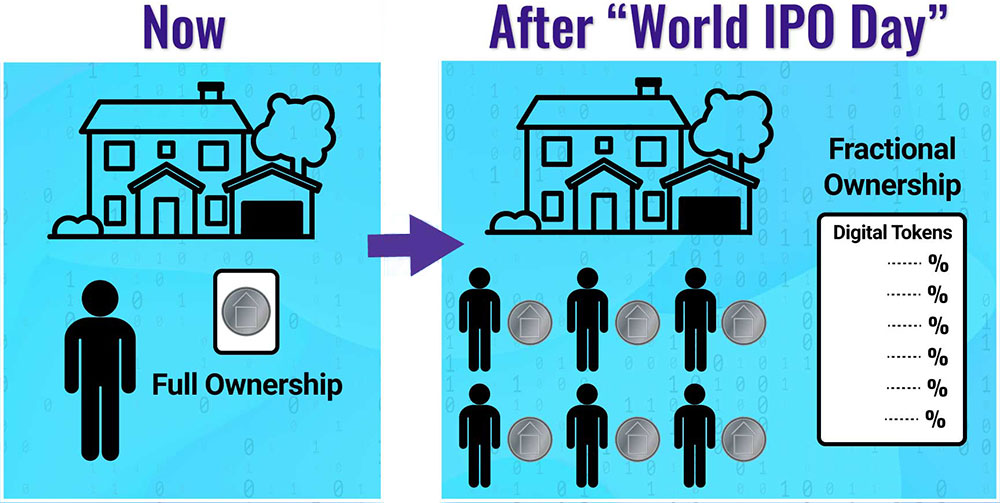

According to Jeff, tokenization can allow you to partially own a costly asset, such as a piece of art or property. Could this be completion of time-shares as we know them? On the planet economy, you would probably agree that most of properties are owned by someone or company.

The procedure makes good sense realistically that many people can't manage a holiday home themselves, so they divided up the ownership amongst 50 other owners and each takes one week of the year to stick with two weeks reserved for upkeep and upgrades. Where timeshare is limited based on "usage" there is no limitation in tokenization as a property can be sculpted up in a boundless variety of pieces to own.

Something went wrong. Wait a moment and try once again Attempt once again.

Jeff Brown, a renowned tech forecaster, declares that he predicted the 2016's, 2018's, 2019's, and 2020's no. 1 tech stocks. Lots of financial investment analysts have actually been paying fantastic attention to the recent presentation of Jeff Brown's GTE technology. In his discussion, he appropriately states that GTE is an innovation that what is g.t.e. technology will produce the biggest buy-and-hold opportunity.

He states that this event will view as many as 20,000 "IPOs" releasing in a single day. And, he states that it will be the most significant monetary event in human history. There's something we should clear here. And that is, what does Jeff Brown describe when he states IPO? Here he isn't describing Initial Public Offerings in a common sense.

Nor it has to do with what he went over inside The Crypto Effect. Rather he's describing a new innovation, which with the help of a concept called tokenization, is altering the world of finance. This new technology allows you to own and trade possessions. Discussing the concept of tokenization, he states that financiers can own anything on earth with the help of tokenization.

And by anything, he indicates anything from real estate, a car, artworks, racehorse, software application programs, to novice cards. Not only this however all of these things become tradeable. He says that tokenization is currently occurring, and it's not something that's going to take place in the remote future.

It could have just $206 for which financiers had purchased units of ownership. This is what Jeff Brown is describing. Asset tokenization is the process in which a company creates digital tokens on a blockchain, and hence, represents ownership of a possession. The term possession here suggests digital or physical goods.

Jeff states that GTE isn't the very same thing as NFTs. Here is the possible projection of gte innovation that how high its cost can get in 2022 approximately 2025 read here. A non-fungible token (NFT) is an unit of data that is stored on a blockchain to symbolize the ownership of a digital possession.